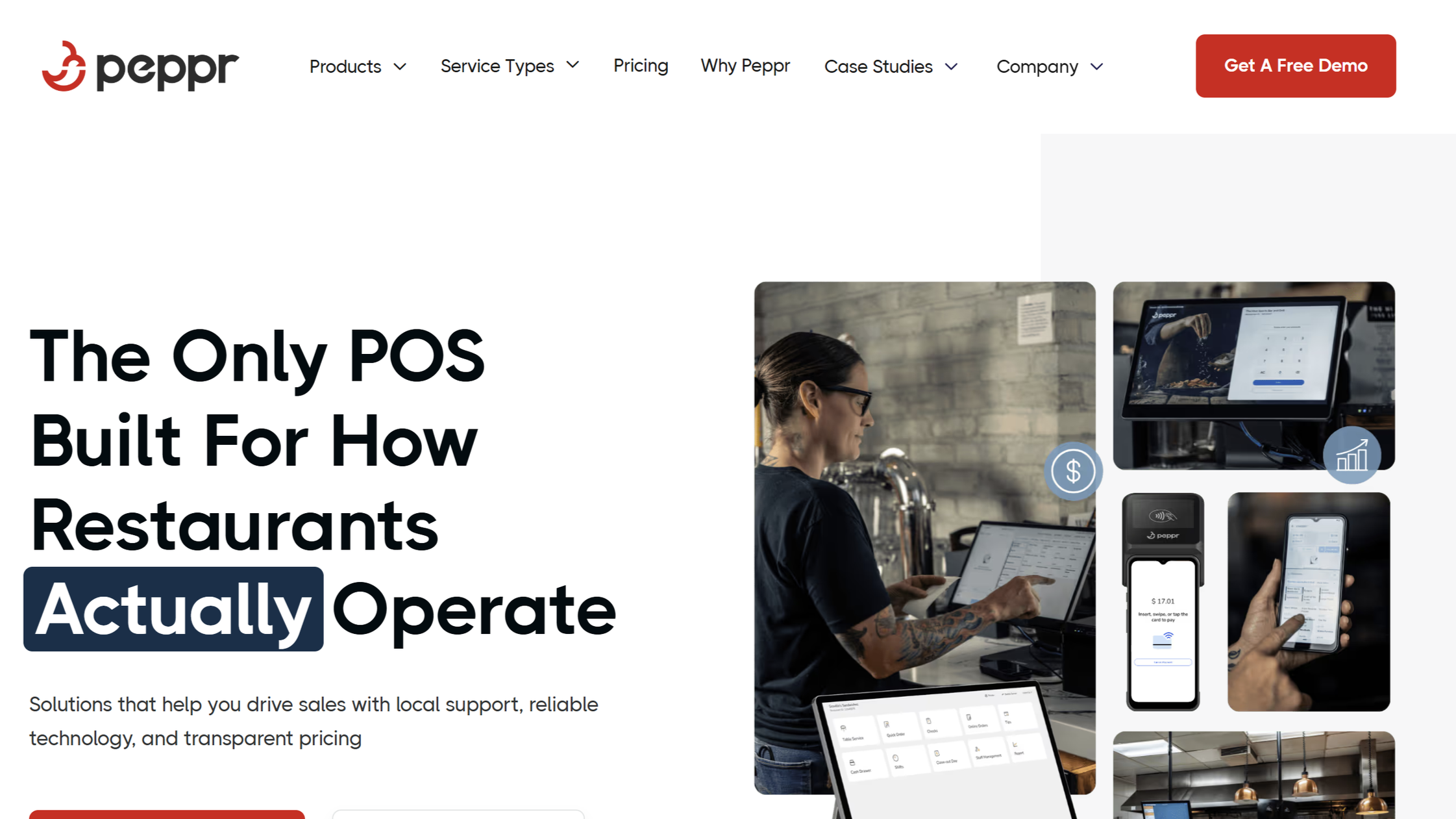

Peppr

Industry: Restaurant POS

My Role: SEO/AEO Content Strategist

Timeline: July 2025 - January 2026

Deliverables: Increased Traffic, Improved Domain Reputation Blog Content, Optimized Landing Pages

Graeme is the kind of SEO partner every company hopes to find.

Over 2025, he helped my company make significant progress in organic growth. He didn’t just pass along blog articles and call it a day. He analyzed our web pages and delivered detailed reports that were actionable. We got clear roadmaps we could execute on immediately.

Marketing lead at Peppr

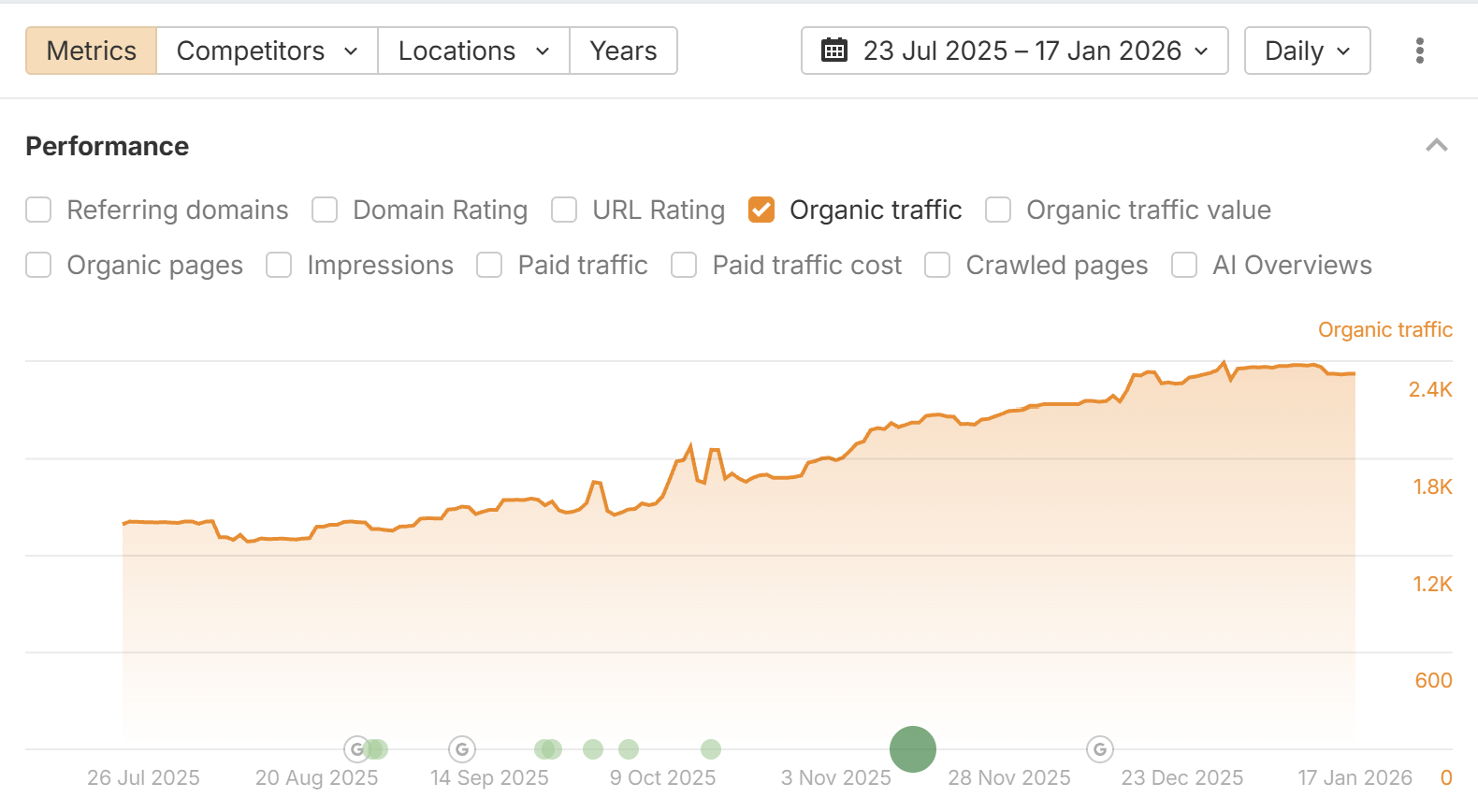

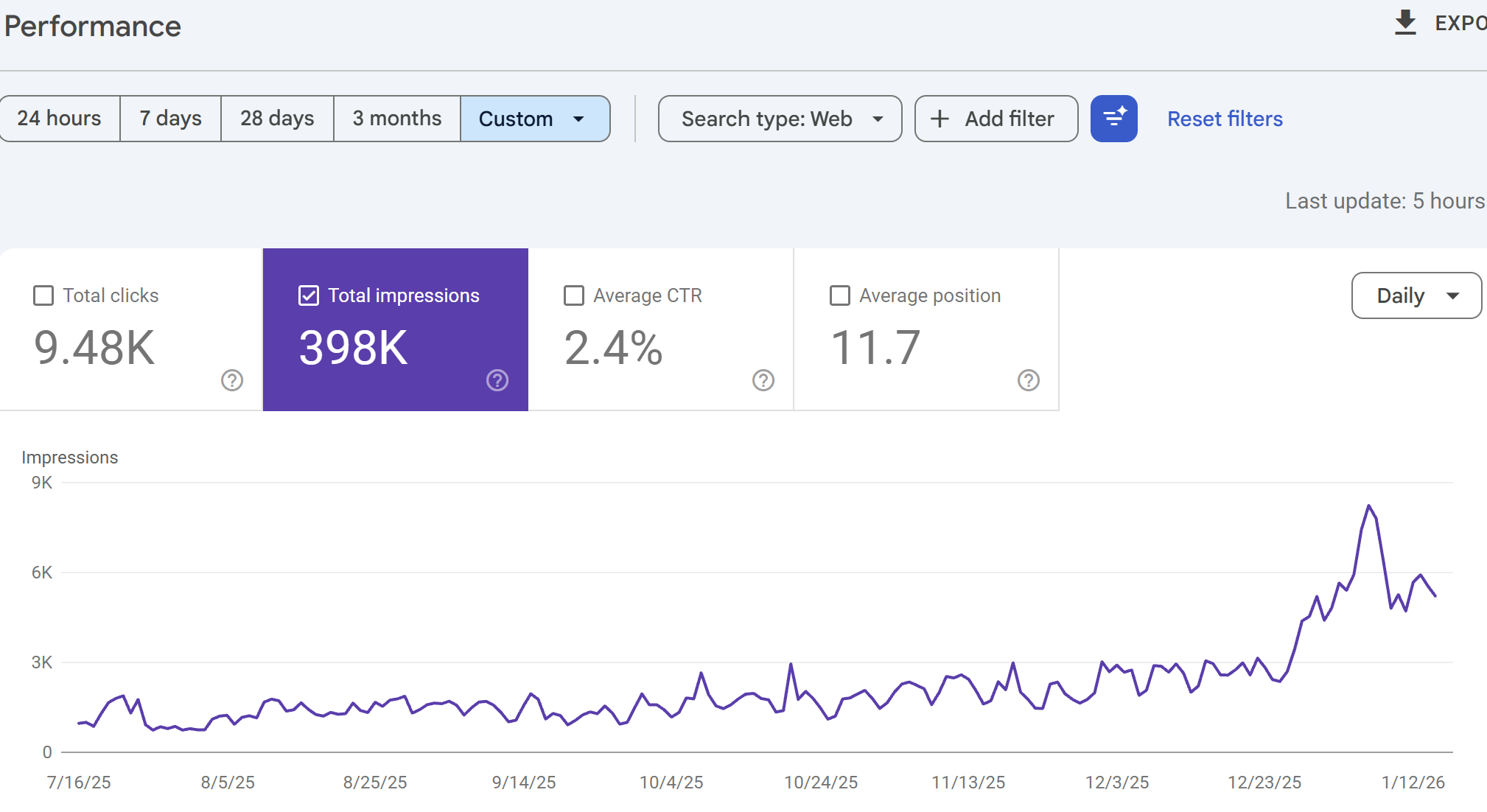

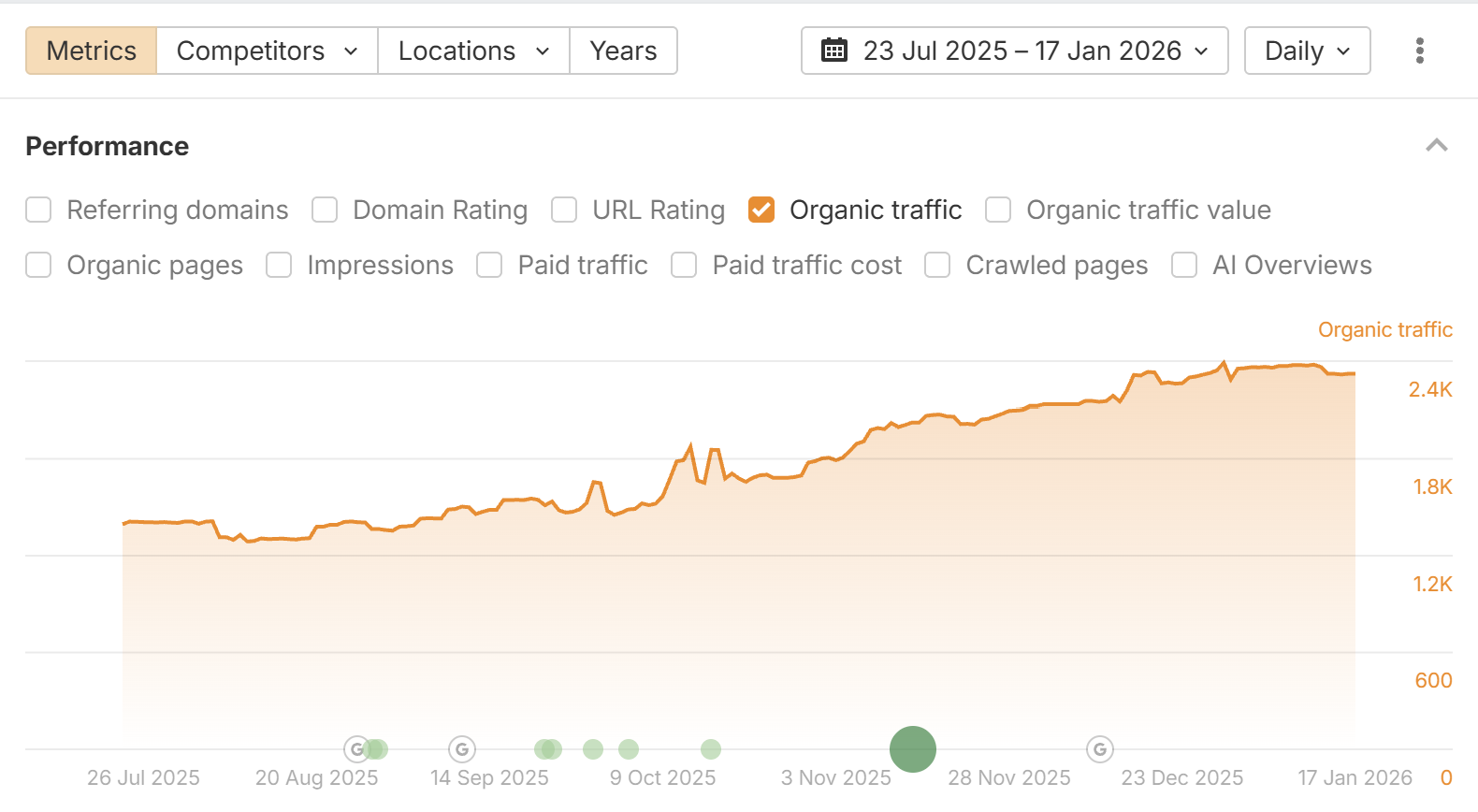

Increased Organic Traffic from 1395 to 2322 (+66.45%)

Key Wins

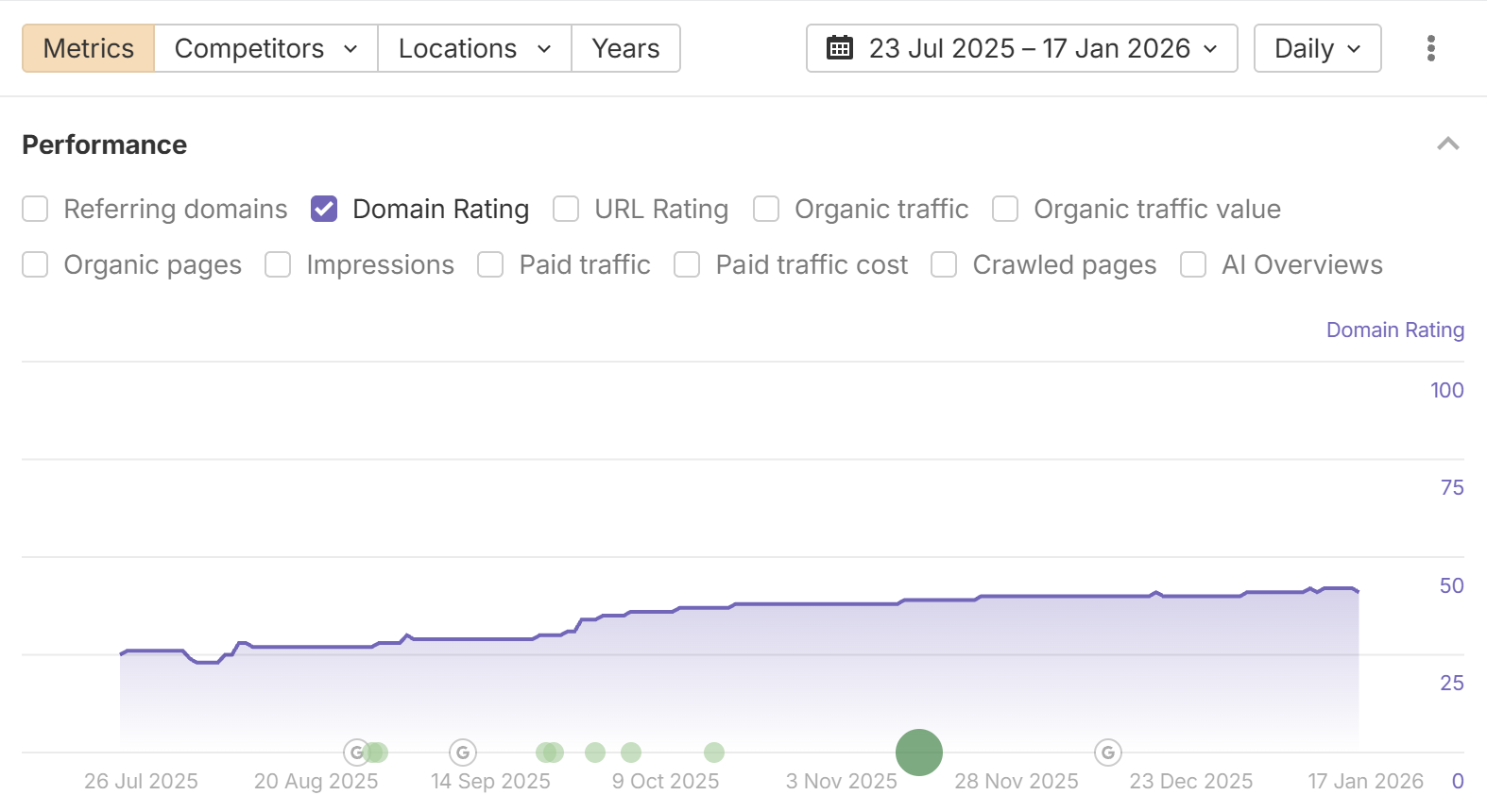

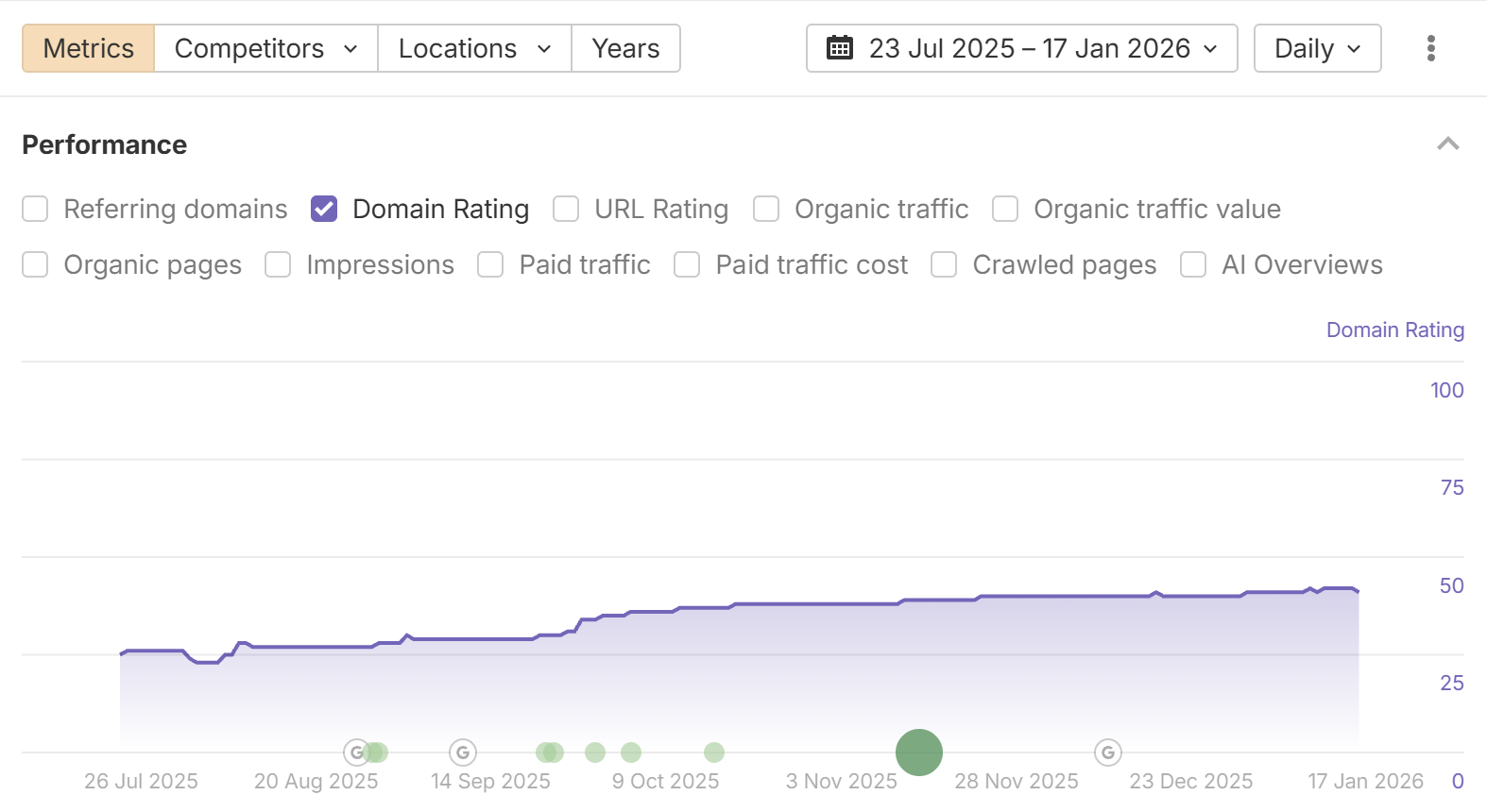

Increase company DR rating from 24 to 42 (+75%)

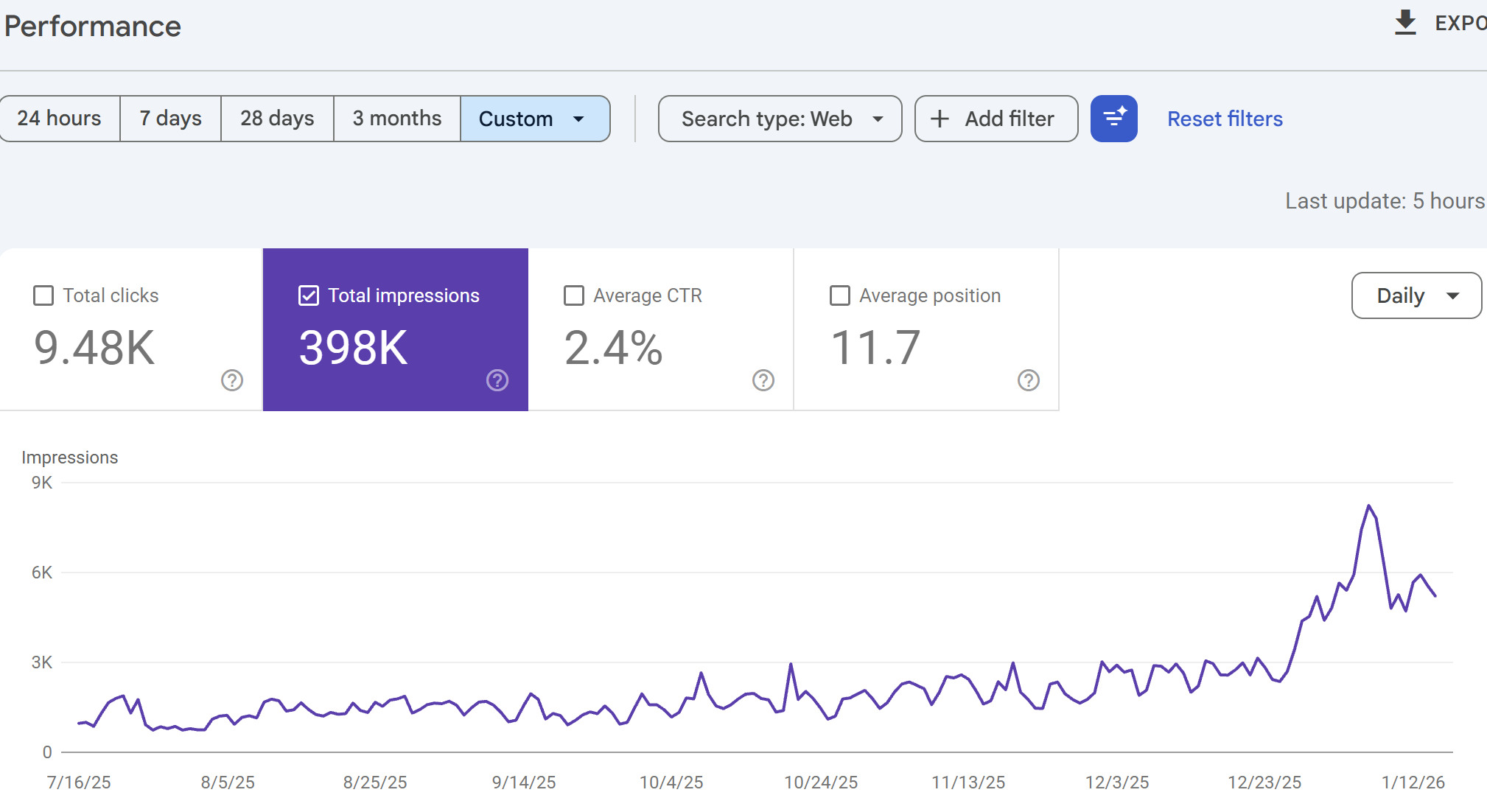

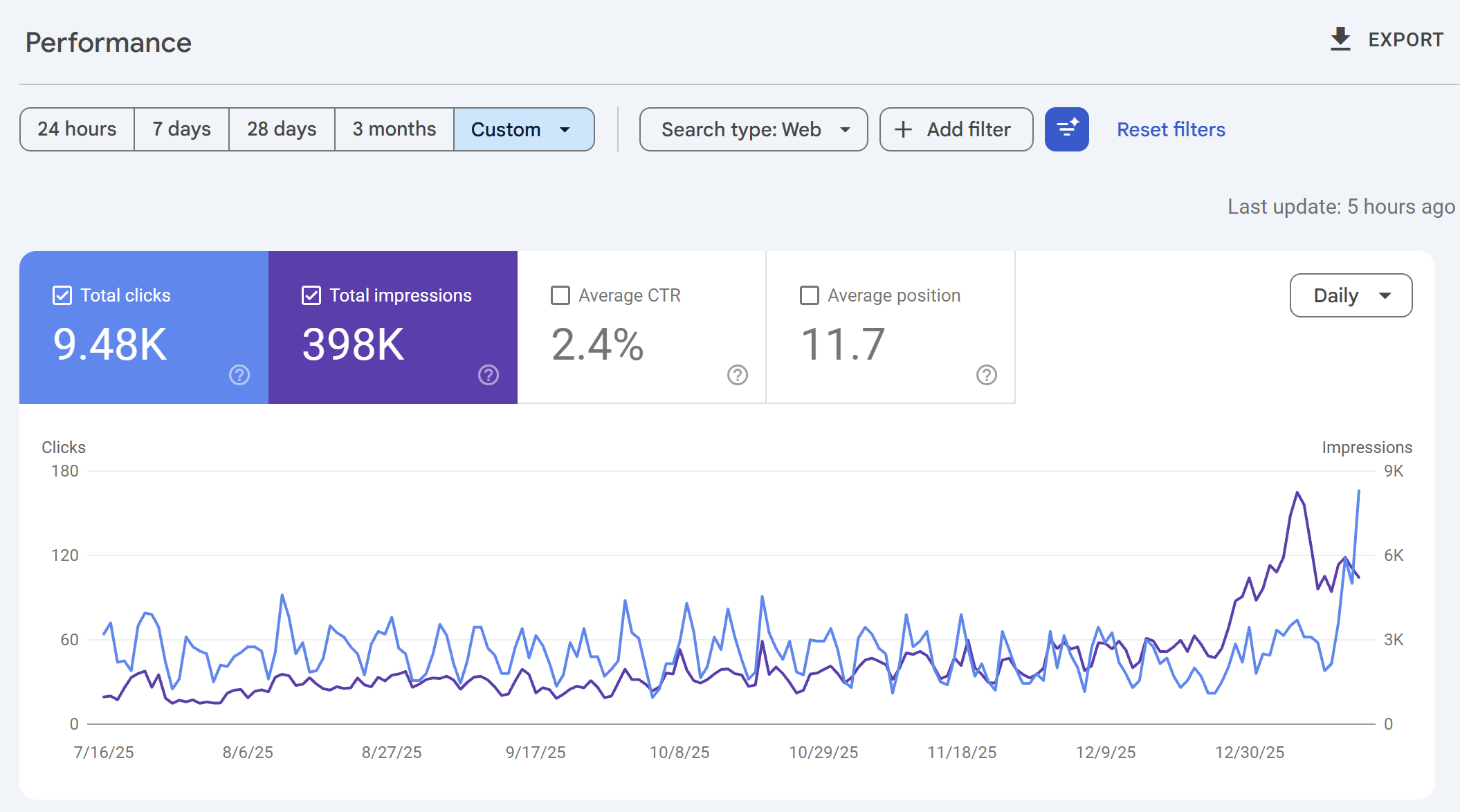

Grew Impressions from 966 per day to 8240 (+752.9%)

Want similar results?

The Challenge

When Peppr approached me in mid-2025, they faced several critical challenges:

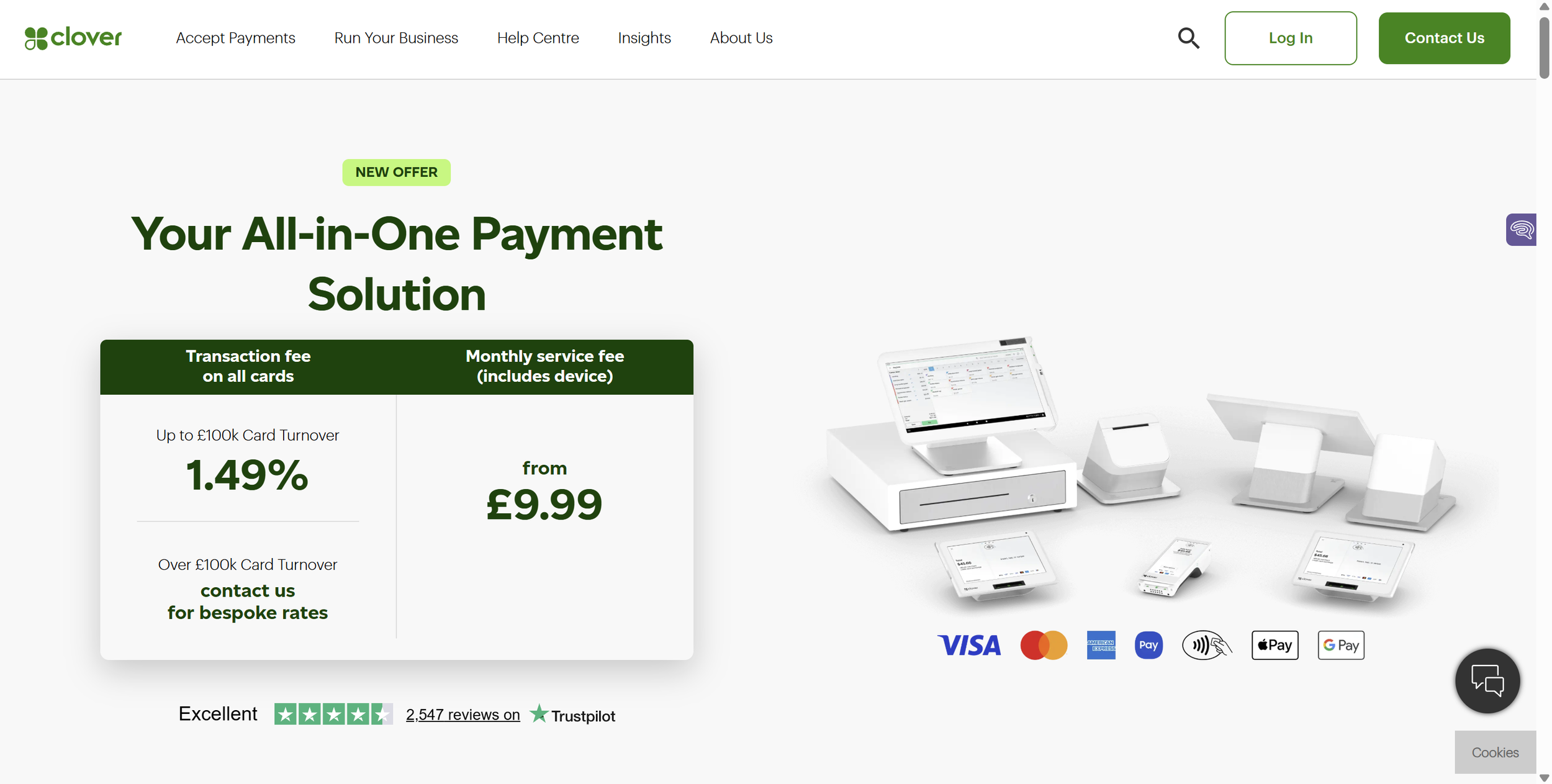

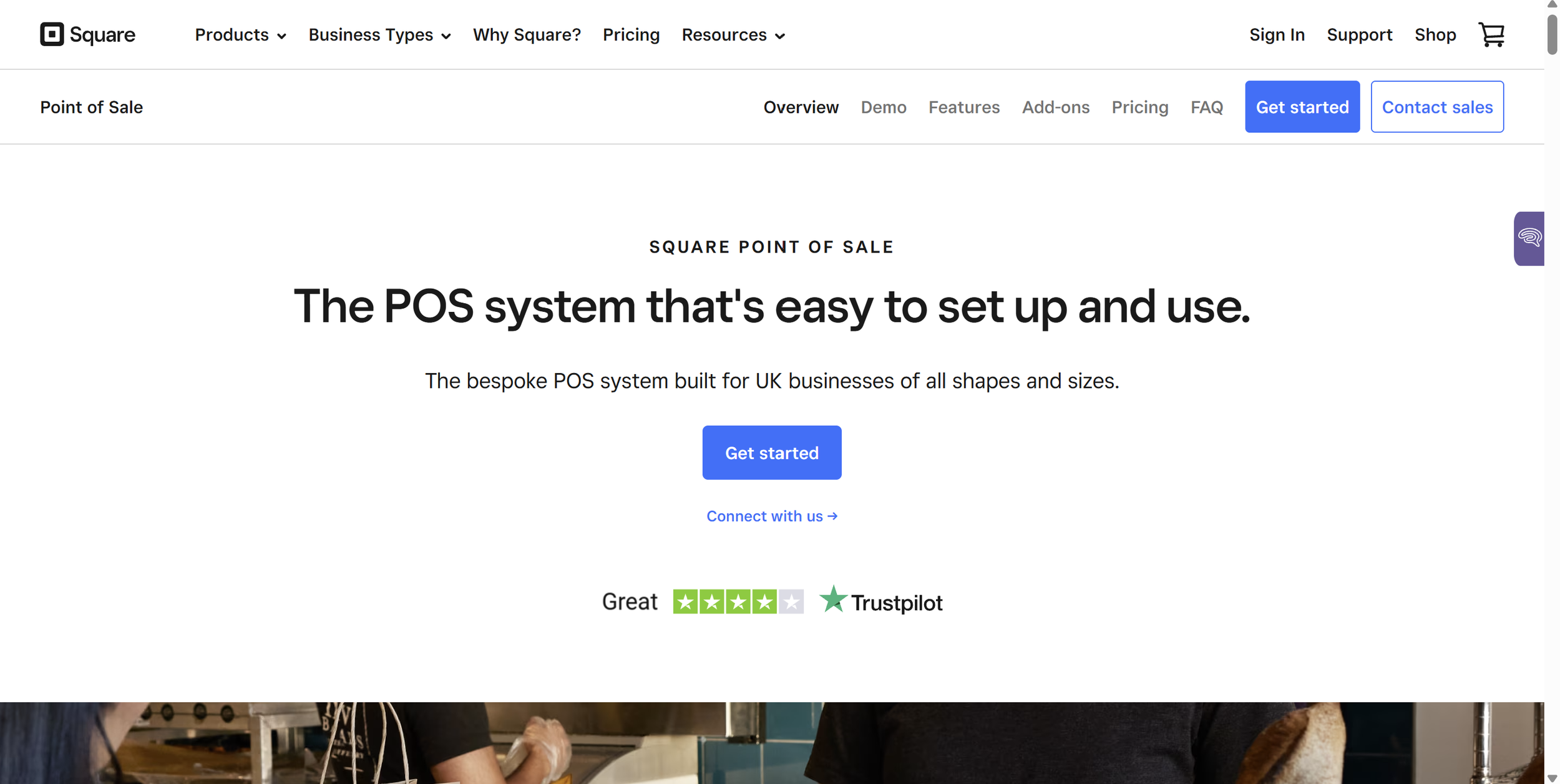

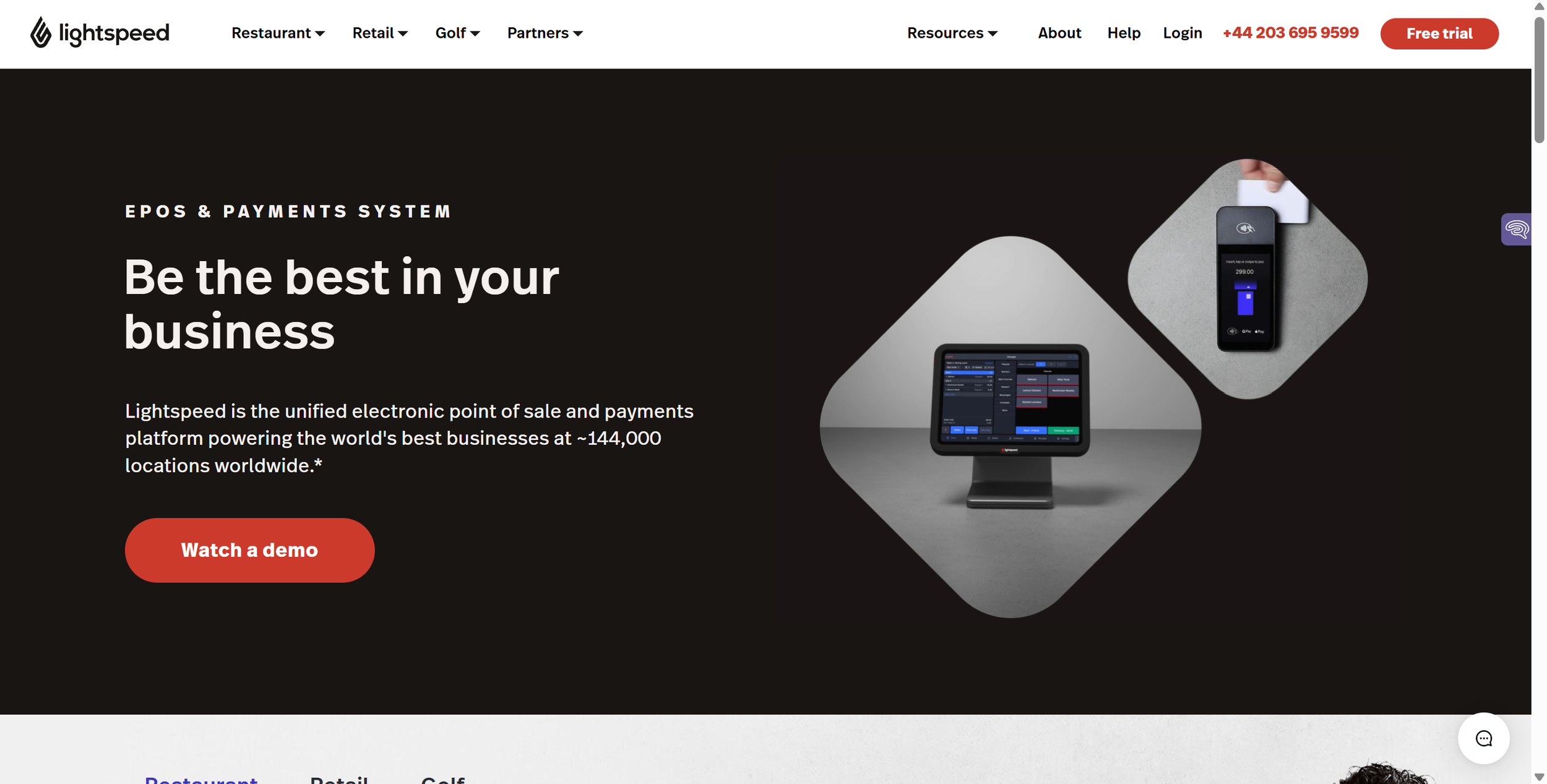

Low domain authority (DR 24), making it difficult to compete with established POS providers like Toast, Square, and Clover

Minimal organic visibility with only 27,152 impressions over a 4-month baseline period

Missing from key consideration sets - not appearing in Google's "Sources Across the Web" or ChatGPT responses for restaurant POS searches

Limited content infrastructure to capture high-intent comparison and alternative searches

New site baseline - recently relaunched with limited search history and backlink profile

The restaurant POS market is highly competitive, with well-established players dominating search results. Peppr needed to build visibility quickly while establishing long-term authority in a crowded marketplace.

My Strategy

To achieve this, I mapped out a clear three-pronged approach, staggered into two key stages.

Phase 1:

Research & Foundation (Month 1)

I began with comprehensive competitive analysis and strategic planning:

Competitive Keyword Mapping

Analyzed Toast, Square, Clover, TouchBistro, and Lightspeed's content strategies

Identified 50-60 high-value topic opportunities across comparison pages, alternatives content, and persona-specific landing pages

Mapped keyword clusters by restaurant type (quick service, full service, bars & breweries)

Technical SEO Audit

Conducted a comprehensive technical assessment, identifying crawlability and indexation opportunities

Developed site structure recommendations to support topical authority

Created an internal linking strategy to distribute authority to priority pages

AI Optimisation Strategy (AEO)

Analysed Peppr's visibility in ChatGPT, Google AI Overviews, and Perplexity

Identified entity gaps preventing inclusion in AI-generated restaurant POS lists

Developed a semantic optimisation framework for LLM discoverability

Phase 2:

Content Production & Optimisation (Months 2-7)

I then implemented a systematic content strategy focused on three content types:

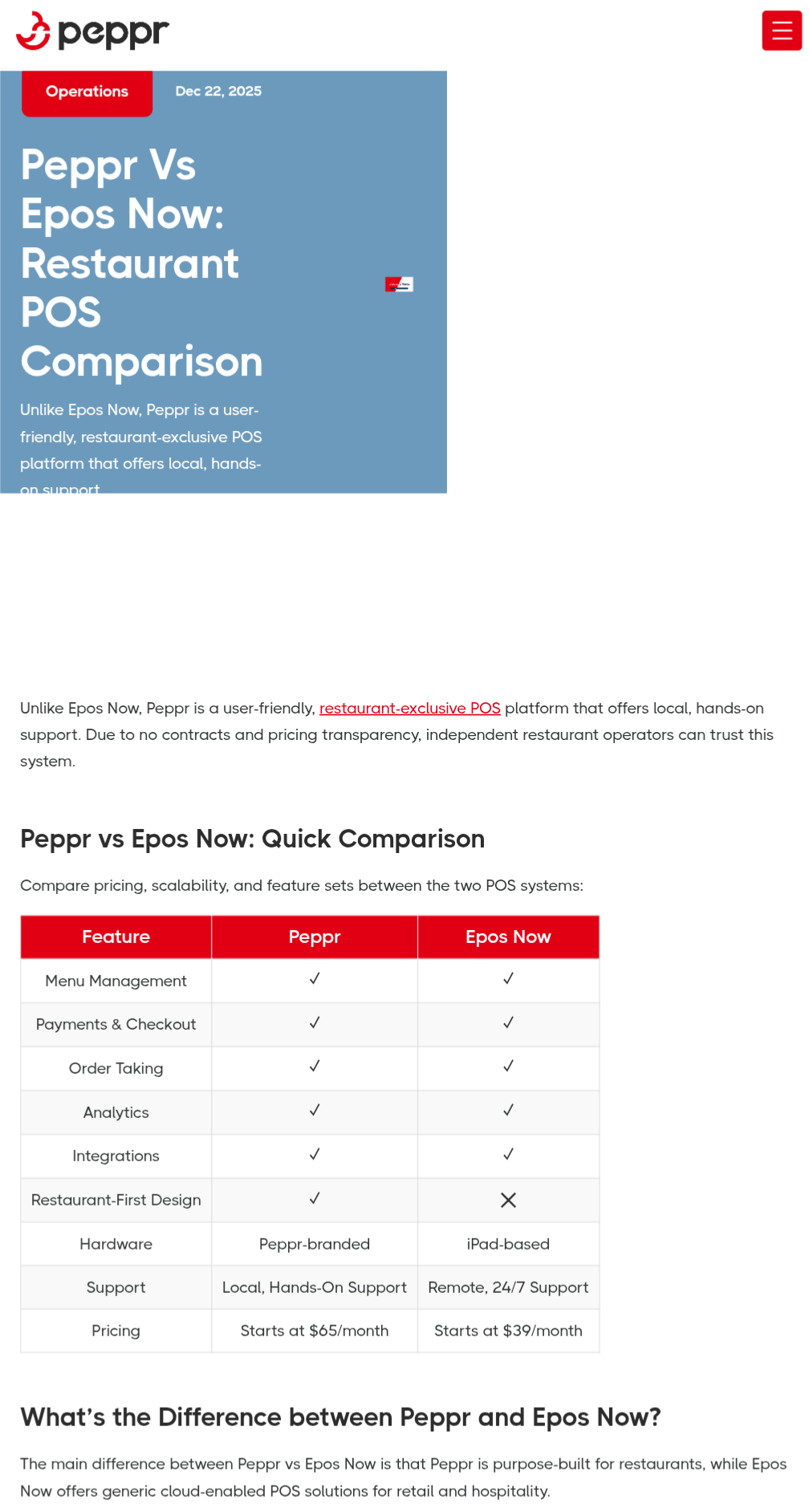

1. Comparison Content

Created comprehensive "Peppr vs [Competitor]" pages targeting high-intent switcher searches

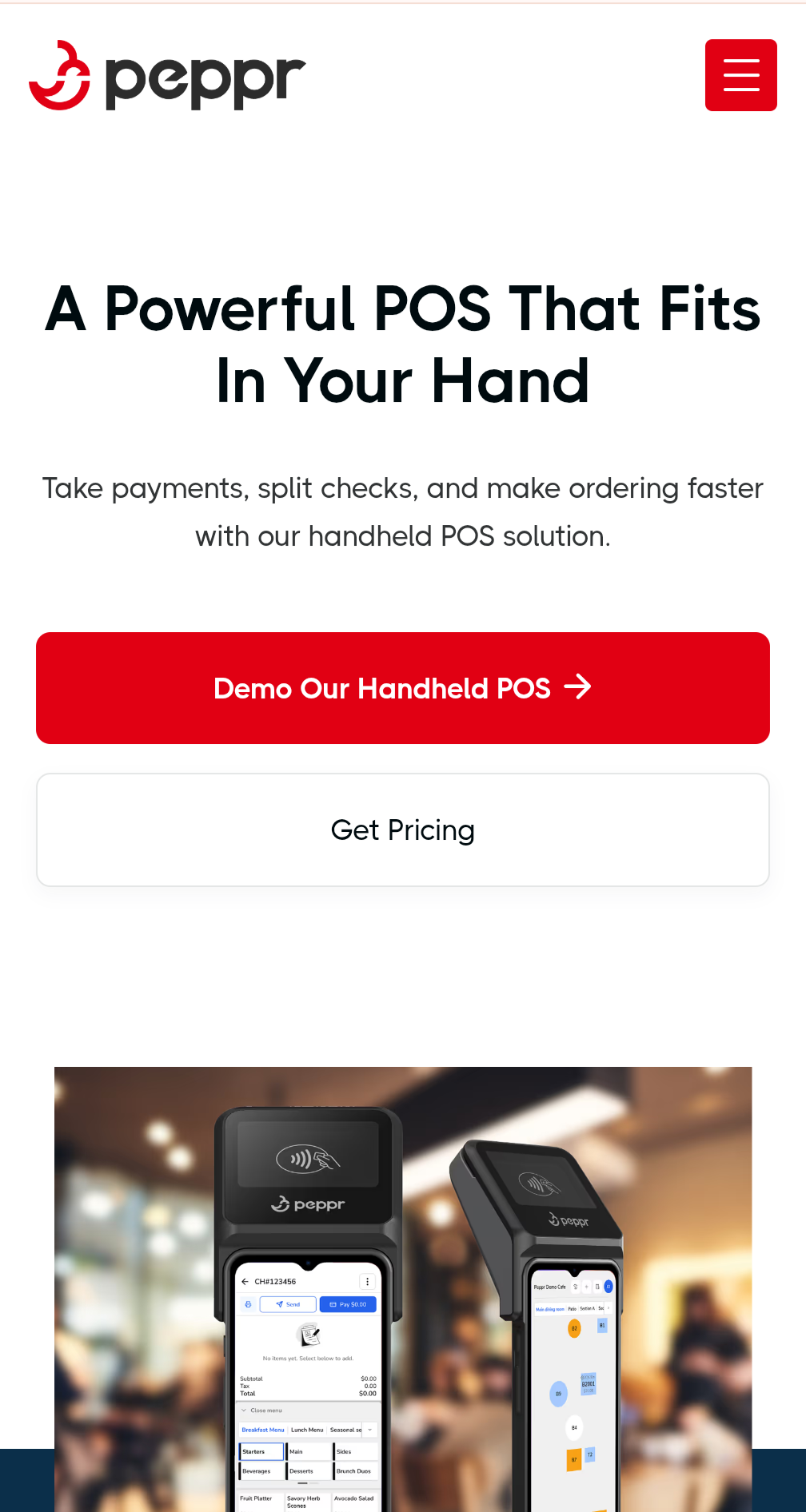

Developed feature-specific comparisons (e.g., "Peppr vs Toast | Handheld POS")

Focused on Peppr's key differentiators: integrated marketing solution, transparent pricing, hands-on support

2. Alternative Pages

Built "[Competitor] Alternatives" content to capture research-phase buyers

These pages significantly outperformed direct comparisons (149 views vs 29 views for Clover content)

Positioned Peppr as the recommended alternative within comprehensive option sets

3. Segment-Specific Content

Created vertical-specific landing pages for quick service, full service, bars, and specialised restaurant types

Developed educational authority content addressing real operational challenges

Built thought leadership through practical, actionable guides

Content Production Framework:

12 new articles per month focused on commercial-intent topics

CustomGPT editor trained on Peppr's product positioning and voice

Template-driven approach for scalable, consistent quality across comparison and alternative pages

Phase 3:

Authority Building & Technical Excellence

Backlink Strategy

Procured 3 DR60+ backlinks monthly targeting restaurant tech directories and hospitality publications

Grew domain authority from DR 24 to DR 40 (+67%) in 6 months

Particularly strong Q4 performance with +11 DR points in Sept-Oct alone

On-Page Optimization

Optimised homepage and product pages for primary commercial keywords

Implemented semantic overlap strategy and FAQ schema for AI search visibility

Created a dedicated AI information page, positioning Peppr for emerging search platforms

Conversion Optimisation

Enhanced internal linking to guide users from awareness to decision-stage content

Optimised demo page CTAs and conversion path

The Results

Organic Visibility: 752% Impression Growth

Daily impressions increased from 966 to 8240 (+752.0%)

Site now appears for 8.6x more searches

Achieved visibility across hundreds of new keyword opportunities

Traffic: 83% Click Growth

Clicks increased from 3,516 to 6,445 (+2,929)

Daily organic clicks increased from ~29 to ~52 per day

Domain Authority: 75% Increase

Domain Rating surged from 24 to 42 (+18 points) in 6 months

Strong Q4 performance with +11 points in Sept-Oct alone

Now competitive with established mid-tier POS providers

Conversions: 5,000+ Demo Requests

Tracked 5,000+ key events (demo form submissions) from June-December

Strong conversion rates on key pages (3-4% on demo-specific landing pages)

Multiple conversion paths established across product and comparison content

Content Performance Highlights

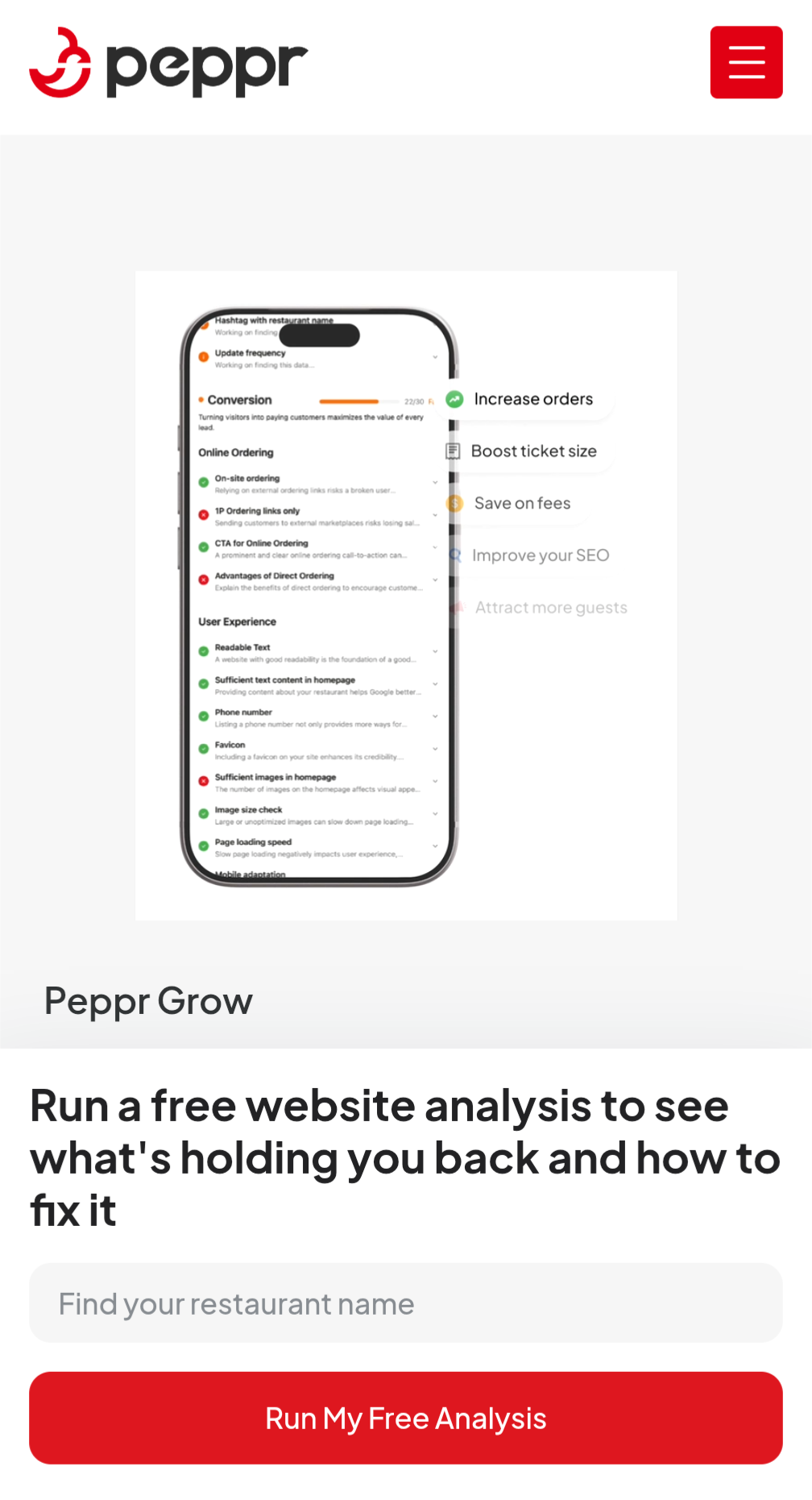

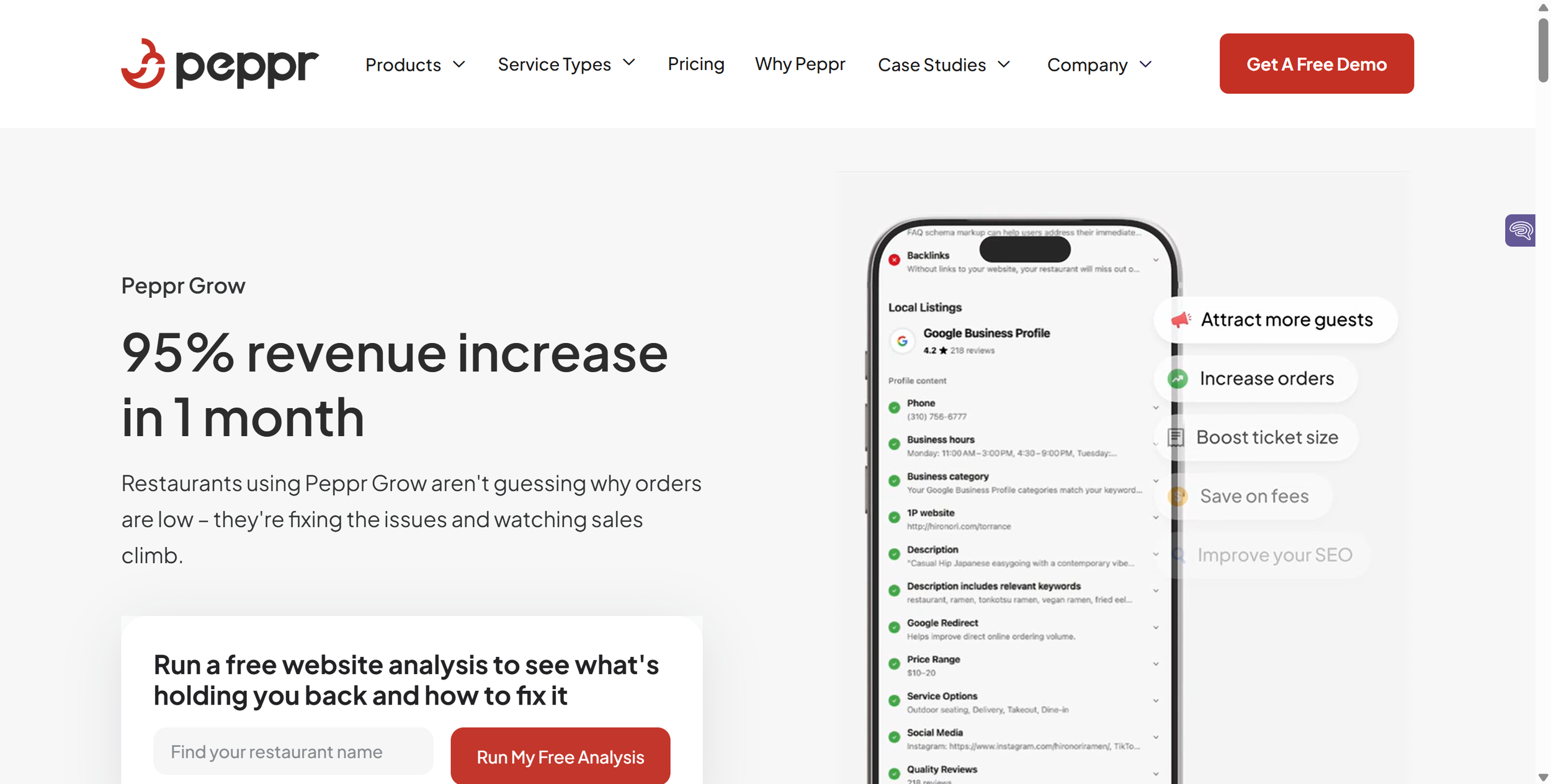

Peppr Grow Product Pages - 67,415 views

Primary traffic driver validating integrated marketing solution positioning

718 tracked conversions

Average engagement: strong session duration, indicating quality traffic

Competitor Alternative Pages

Clover Alternatives: 149 views (outperformed direct comparison by 5x)

Aloha Alternatives: 177 views + 3 conversions

Toast Alternatives: 90 views

Educational Content

"15 Most Profitable Food Truck Ideas": 1,375 views, 25.55s avg engagement

Built thought leadership authority in the restaurant operations space

Top Performing Assets

Key Strategic Insights

Data showed users prefer comprehensive option exploration over direct head-to-head comparisons:

Alternative pages received 149-177 views vs 29-54 views for direct comparison pages

Users searching for "[competitor] alternatives" are earlier in research phase with higher engagement

Strategy: Position Peppr as recommended alternative within comprehensive competitor analyses

Educational Content Drives Quality Traffic

High engagement on operational content (25+ second averages) demonstrates Peppr as a thought leader:

Users consuming educational content are high-value prospects working to improve restaurants

Lower direct conversion but supports top-of-funnel awareness and authority building

Requires a conversion bridge through content-specific lead magnets and soft CTAs

Returning User Patterns Reveal Intent

High-intent pages showed 2-3x higher returning visitor rates:

Pricing page: 28% returning users

Product pages: 20-27% returning users

Blog content: 6-15% returning users

Indicates research cycle where users comparison shop before converting

Peppr Grow Represents Competitive Differentiation

Combined Grow pages generated 72,000+ views, significantly outperforming traditional POS product pages:

Integrated marketing/online ordering solution differentiates from pure POS competitors

Restaurant owners are actively seeking digital sales solutions, not just transaction processing

2026 priority: Double down on Grow-focused content and positioning